Note: This article is based on my presentation to the Mines & Money Conference on 27 November 2017. Good afternoon ladies and gentlemen. The title of my presentation is “Positioning Yourself for a New Bull Market in Gold”. I highlighted ’New’ because gold’s bull market actually began a century ago when central banks started takingRead more

Blog

Leverage is the use of credit or borrowed capital to increase the earning potential of your investment portfolio. But like everything else in finance, higher returns mean higher risk, so leverage is not for everyone. Nevertheless, leverage can be a useful tool for those accepting the risk. If you choose to use it to maximiseRead more

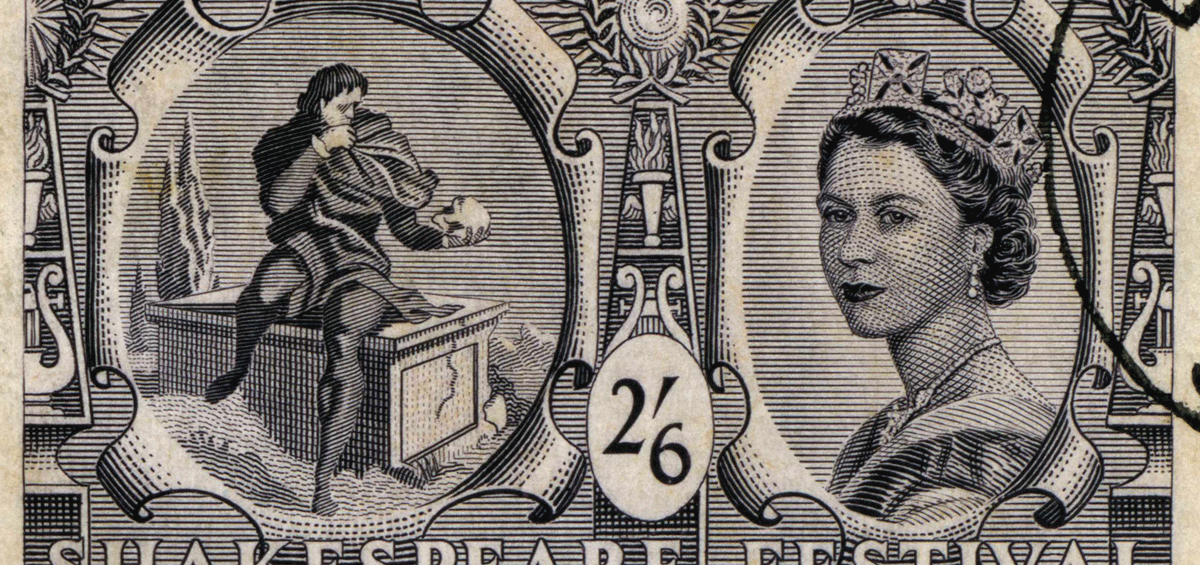

We are told by Shakespeare: “Neither a borrower nor a lender be.” Is it good advice? Like so many things in life, the answer is – it depends. Individuals are different, and what is right for one person may not be suitable for another. What’s more, everyone’s circumstances are different, which may require differentRead more

Transferring Power to the People Of the many significant statements made by President Donald Trump in his inaugural address, I believe the following stands out: Today, we are not merely transferring power from one administration to another or from one party to another, but we are transferring power from Washington, D.C. and giving it backRead more

How Much Did It Cost to Build the Titanic I recently received a link to an article in The Vintage News with an eye-catching headline: “The replica Titanic cost $435 million & is set to launch in 2018”. I was intrigued, so I couldn’t resist reading the article. It reported that an Australian billionaire wasRead more

The US federal government’s financial accounts end each year on September 30th. Last week the Treasury Department reported the government’s financial position for the fiscal year ended 2016, and it does not look good. I will ignore for the moment the government’s negative net worth, which itself means that the federal government owes more thanRead more

The following exchange occurred on December 18, 1912 when J.P. Morgan – the most influential American financier and banker of his time – was called to testify before Congress. Mr Untermyer: I want to ask you a few questions bearing on the subject that you have touched upon this morning, as to the control ofRead more

It is assumed that before the most primitive currencies emerged, civilizations sustained themselves through subsistence and barter. This meant that most people either, produced all they needed by themselves, and later, exchanged basic goods like vegetables, livestock, tools, and weapons to meet needs. As civilizations grew, and more efficient systems were needed, gradual change began,Read more

Inflation is an intrinsic property of fiat currency. This vulnerability lays the foundation, for chaos in any poorly managed economies facing a recession. Commonly defined as a period of rapid and uncontrolled inflation, Hyperinflation is characterized by a rate of inflation that exceeds 50% per month. Hyperinflation not is some obscure and rare phenomenon thatRead more

The monetary history of the Swiss Federation is almost as eventful and momentous as the rest of its history between the 17th century and the present. Banking Secrecy The notorious culture of secrecy, Swiss banking traditions are known to predate the federation itself. As Financial News explains: The 1713 Great Council of Geneva formally adoptedRead more

My objective is to share with you my views on gold, which in recent decades has become one of the world’s most misunderstood asset classes. This low level of knowledge about gold creates a wonderful opportunity and competitive edge to everyone who truly understands gold and money.

My objective is to share with you my views on gold, which in recent decades has become one of the world’s most misunderstood asset classes. This low level of knowledge about gold creates a wonderful opportunity and competitive edge to everyone who truly understands gold and money.